Also, many of these deals are callable soon (2022 – 23) and it makes economic sense to refinance them given currently tight spreads.

In our view, fundamentals are sound as house prices have strongly increased, unemployment is going down and there is some nominal pressure on wages. buy-to-let, Irish Re-performing, buy-to-let and European NPL deals, across the whole capital structure. They generally offer spread pick-up versus credit with same rating, and they offer a natural hedge for rates risk in portfolios, given their floating-rate nature.

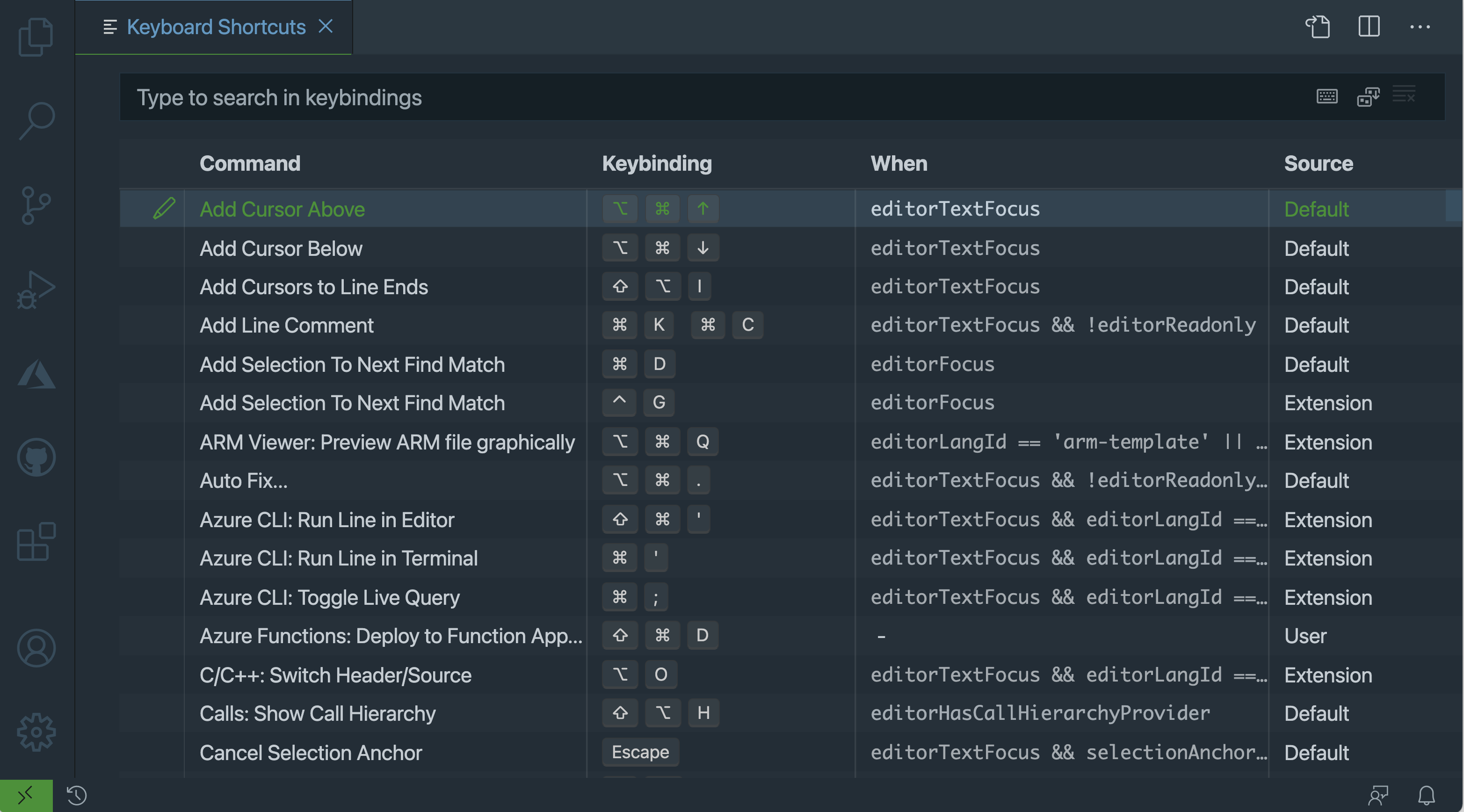

Vs code change cursor color full#

Notwithstanding full valuations, we still like European ABS. As in 2021, we expect that new issues will be easily absorbed by the market as volumes remain relatively small compared to other asset classes. We are thus expecting light growth in new ABS deals for next year, with, again, the strong participation of CLOs. Also, a new TLTRO plan cannot be ruled out, and we will likely have more details on the upcoming December ECB meeting. Also, we believe that central banks, especially the ECB, will keep an accommodative stance in its monetary policy, through an increase of bond purchases via the APP program, which will continue after PEPP stops in 2022. Their need to tap the market for funding should be rather limited. and European banks have accumulated excess deposits in 2021, and loan-to-deposit ratios are currently running at the lowest levels seen over the past several years. We must highlight, however, that both U.K. Indeed, the very low rates of TLTRO might be ended next year and a big chunk of pandemic borrowing is coming due in 2023. In 2022, this new issue trend might even accelerate as the ECB and BOE start tapering, both through lower volumes of bond purchases and through a slowing of the above-mentioned cheap funding programs. Considering that the TLTRO and TFSME funding programs disrupted bank-led securitization in Europe by providing ultra-cheap funding for banks, the growing volume of issuance in the recent years after the global financial crisis is even more meaningful. Notwithstanding valuations, we anticipate opportunities in various areas of the European asset-backed securities market in 2022.Ģ021 has been a record year for European securitization, with almost €100 billion in new deals issued to date, of which around €40 billion was leveraged loan CLOs.

0 kommentar(er)

0 kommentar(er)